How Crypto Mining Data Centers Are Pivoting to Hybrid Infrastructure

Crypto mining data centers—specialized facilities built to handle energy-intensive blockchain computations—are undergoing a transformative shift. Originally designed for Proof-of-Work (PoW) mining like Bitcoin’s SHA-256 or Ethereum’s former GPU-based mining, these facilities are now attracting institutional investment not just for their hashpower, but for their potential as high-performance compute hubs.

So why are institutional players doubling down on hybrid mining method and infrastructure? The answer lies in their unique advantages: low-cost energy access, industrial-scale cooling systems, and hardened operational setups—all critical for next-gen workloads like AI training, zero-knowledge (ZK) proof generation, and decentralized cloud services. With Bitcoin mining margins under pressure from energy volatility and halving cycles, operators are pivoting to hybrid infrastructure models, blending traditional mining with AI and modular blockchain compute.

This transition is possible because mining data centers already possess the core requirements for high-performance computing: abundant power, optimized thermal management, and scalable physical footprints. By repurposing their infrastructure, they can simultaneously mine crypto while renting out excess capacity for AI inference, L2 rollup proving, or cloud rendering—turning volatility into diversified revenue streams. The result? Mining facilities are no longer single-purpose operations but adaptable, multi-tenant compute powerhouses at the heart of the AI and Web3 revolution.

Real-World Case: Miners Become AI Infrastructure

Leading crypto infrastructure providers are already making the move. Core Scientific, one of North America’s largest Bitcoin mining firms, has begun converting up to 800 MW of capacity to host AI workloads through a partnership with CoreWeave, a hyperscaler for machine learning and 3D rendering. As of mid-2025, over 60% of its contracted revenue stems from non-mining workloads like AI inference and cloud rendering services.

Similarly, Bitdeer, a publicly listed mining company, has partnered with NVIDIA to deploy AI compute clusters within its data centers in the U.S. and Singapore. These facilities, once dedicated to mining, are now being leveraged to provide cloud GPU infrastructure to support AI training and inference.

These moves highlight how mining infrastructure—originally built for crypto—is now a strategic foundation for AI and next-gen cloud workloads.

Why Hybrid Mining Method Models Work

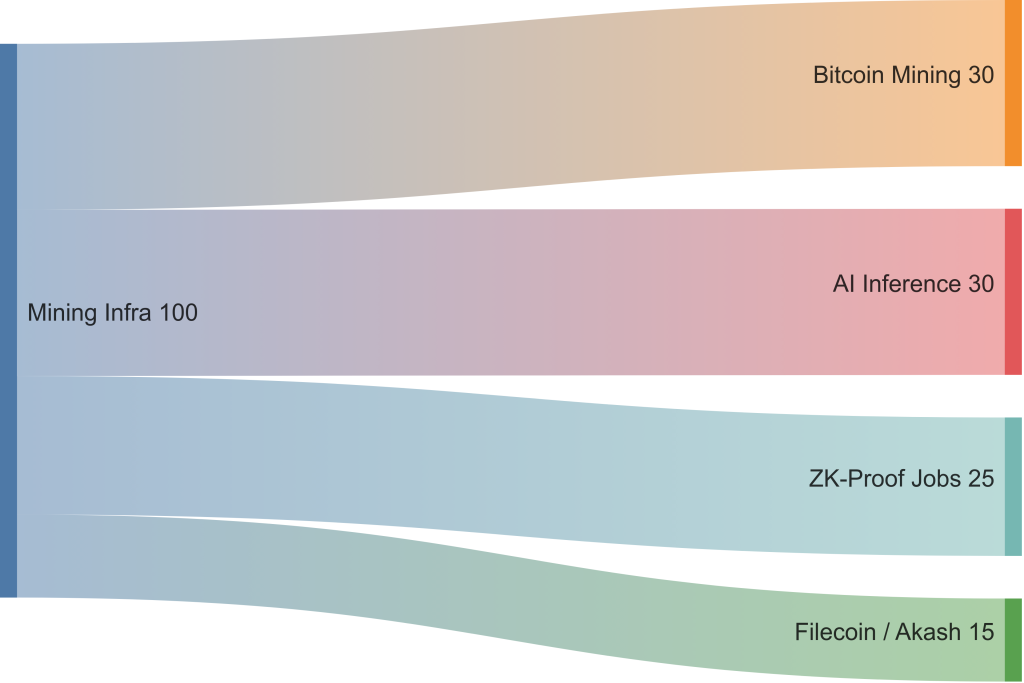

Hybrid infrastructure allows data centers to hedge against hash price volatility while maximizing revenue per kilowatt-hour (kWh). Instead of relying solely on Bitcoin block rewards, operators can fill idle capacity with:

- zk-SNARK proof generation for rollups

- Machine learning inference jobs

- Decentralized network services (e.g. Filecoin, Akash, Render)

By diversifying compute roles, mining centers can:

- Achieve more stable and higher ROI

- Qualify for green compute subsidies or enterprise contracts

- Onboard institutional customers in AI and Web3

What It Takes to Pivot Successfully to Hybrid Crypto Mining

To support hybrid operations, mining data centers need more than just GPUs and power—they need enterprise-grade orchestration, workload scheduling, and flexible billing infrastructure. Key requirements include:

- Virtualization and containerization support (e.g. Kubernetes)

- Workload orchestration platforms compatible with HPC, ZK, and AI

- SLAs and compliance tooling for enterprise customers

- Network bandwidth upgrades to serve multi-client environments

Final Thoughts: Mining Isn’t Dying—It’s Evolving

The evolution of crypto mining facilities into hybrid compute hubs represents more than just an industry pivot—it’s a response to the growing demands of a data-driven economy. As AI, blockchain, and cloud services require increasingly specialized infrastructure, these adaptable data centers are uniquely positioned to meet the need for scalable, high-performance computing.

By embracing hybrid models, mining operators unlock three key economic advantages:

- Meeting Diverse Compute Demand – The ability to simultaneously support AI training, ZK-proof generation, and traditional mining allows data centers to cater to multiple high-growth sectors, maximizing hardware utilization and revenue potential.

- Optimizing Critical Infrastructure – With expertise in energy efficiency, thermal management, and large-scale operations, these facilities can offer AI and blockchain networks the reliable, high-density compute they require.

- Future-Proofing Digital Growth – As industries increasingly rely on decentralized and AI-powered solutions, hybrid data centers ensure that the foundational infrastructure scales alongside technological demand.

The specialization of these facilities doesn’t just benefit their own bottom line—it accelerates innovation across both AI and blockchain. AI companies gain access to cost-efficient, green-powered compute, while decentralized networks leverage hardened infrastructure for more resilient operations.

In this new era, crypto mining data centers are no longer niche operations but essential pillars of the global compute ecosystem. Their evolution ensures that the digital economy has the infrastructure it needs to grow—powering everything from large language models to trustless financial systems.

Ready to Transform Your Mining Facility into a Hybrid Compute Powerhouse?

Whether you’re exploring AI workloads, ZK-proof systems, or decentralized infrastructure services, ChainUp provides the infrastructural tools to support you with confidence.

Book a Strategy Call Today or Schedule a Demo

Let our infrastructure experts show you how to turn mining volatility into performance advantage. You also have the option to schedule a demo, if you’re already certain of a crypto mining business model to deploy.