What Is a Gas Fee in Crypto?

As crypto, DeFi, NFTs, and Web3 apps grow, understanding gas fees in crypto stops being optional. Every time you send ETH, swap tokens on a DEX, or mint an NFT, you pay a gas fee. That cost affects whether a small transaction makes sense, how dApps are designed, and which networks businesses choose to build […]

What Is OpenSea NFT Marketplace?

Since 2017, Non-Fungible Tokens (NFTs) have transformed from a niche curiosity into a multi-billion-dollar industry, reshaping how we think about ownership in the digital age. At the heart of this revolution is OpenSea, the platform that has empowered creators, collectors, and brands to explore the limitless potential of NFTs. While it started as a hub […]

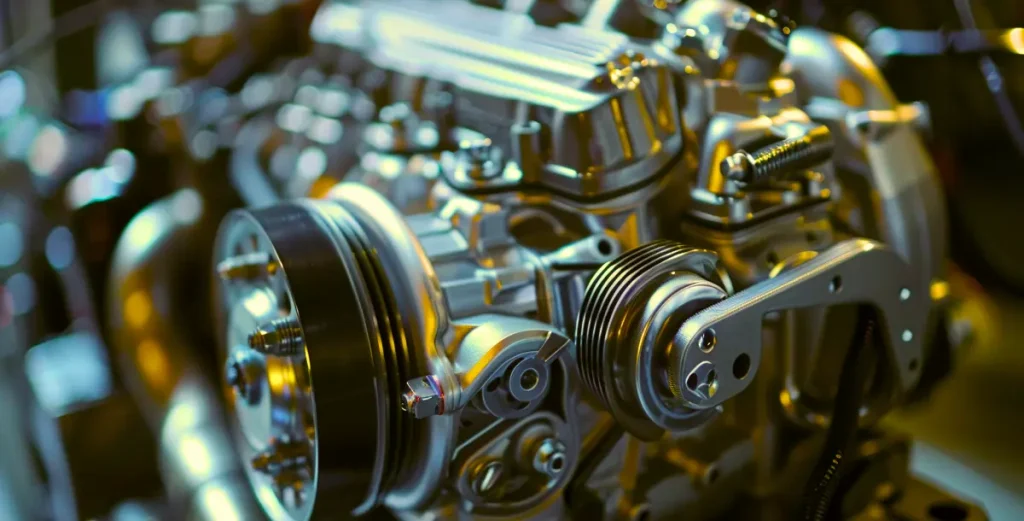

Understanding the Matching Engine in a Crypto Exchange

When you tap “Buy” or “Sell” on a crypto exchange, you see a fill almost instantly. That smooth, rapid experience is powered by one core, high-performance component under the hood: the Matching Engine. The Matching Engine is the specialized software system that continuously pairs compatible buy and sell orders and decides which trades execute, at […]

Why Liquidity Is King: Understanding Market Depth and How It Affects Your Trades

In trading, success often depends on timing, strategy, and risk management. However, a less obvious but more powerful force is at play: liquidity. Liquidity is what determines whether your trade executes at your desired price or slips, costing you money. Without understanding liquidity and market depth, even the best trading strategies can fail. What Liquidity […]

What Is MetaTrader?

MetaTrader sits at the core of global online trading, but the conversation around it has shifted. As brokers expand beyond Foreign Exchange (FX) and Contract for Difference (CFDs) into crypto and multi-asset offerings, choosing between MT4 and MT5 has become a strategic decision, not just a platform preference. This article breaks down why that distinction […]

October 2025 Crypto Crash: A Necessary Deleveraging and Market Reset

Summary of the October 2025 Crypto Crash: The October 2025 crypto crash sent shockwaves through the market as over $19 billion in leveraged positions were liquidated within hours (Oct 10–11), marking one of the largest single-day wipeouts in crypto history. Bitcoin plunged more than 14% to around US$104,782, while Ethereum dropped roughly 12%, according to […]

What is a Grid Trading Bot?

Cryptocurrency markets can feel like a rollercoaster that never stops. One moment you’re celebrating gains, the next you’re watching your portfolio take a nosedive. But what if there was a way to profit from all that price movement without being glued to your computer screen 24/7? Grid trading bots are automated tools designed to help […]

What Is a White-Label Crypto Exchange? (Complete Beginner’s Guide)

In 2025, the global cryptocurrency market recorded trading volumes of $94.35 trillion, reflecting the immense scale and activity within the industry. With over 560 million cryptocurrency users worldwide as of 2024, the demand for crypto exchanges—platforms that enable users to buy, sell, and trade digital assets—has reached an all-time high. Cryptocurrencies have transformed the financial […]

How to Choose a Crypto Exchange: Fees, Security & Liquidity Explained

Picking the lowest crypto exchange fees doesn’t cut it anymore. Now, crypto exchange choice is about matching your risk tolerance, trading style, and compliance needs with a platform that can actually deliver. In 2025, the landscape looks very different from a few years ago: regulators have tightened rules, proof-of-reserves has matured, and stablecoin liquidity now […]

Enterprise-Grade Crypto Exchange Infrastructure: Competing with Industry Giants

Why Robust Crypto Exchange Infrastructure Matters In today’s fast-evolving crypto market, exchanges like Binance, Coinbase, and Bitget dominate with billions in daily trading volume. Their success isn’t accidental—it’s built on high-performance infrastructure, deep liquidity, and flawless execution. For any institution launching or upgrading a crypto exchange, matching these standards isn’t optional—it’s critical for survival. Without […]