What is Crypto Staking: How it works with examples

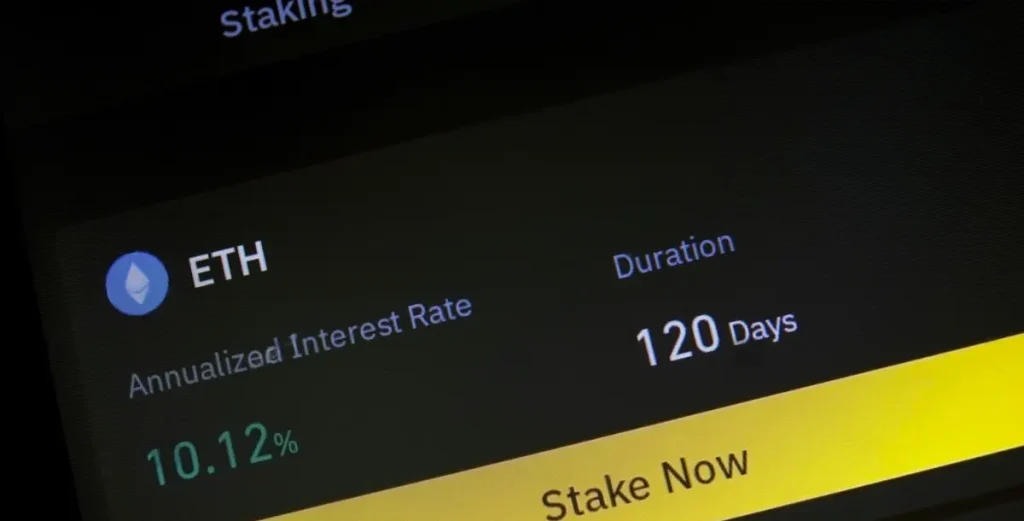

Crypto staking pays rewards for helping secure proof-of-stake (PoS) blockchains. You commit tokens to a network (directly or through a validator/provider). In return, you earn rewards paid in the same token you stake. Staking can turn long-term holdings into a yield stream without day trading or leverage. It still carries real risks: validator penalties, lock-ups, […]

The Risks of Crypto Staking: Slashing, Lock-Up Periods, and Volatility

Crypto staking has become a popular way to earn passive income. By locking up tokens to help secure a proof-of-stake (PoS) blockchain, you can earn rewards over time. But crypto staking isn’t as simple—or risk-free—as it may sound. Beneath the promise of attractive yields are three critical risks that every token holder should understand: slashing, […]

Is Crypto Staking Still Profitable in 2025?

When crypto staking first emerged, it was marketed as the passive-income counterpart to energy-hungry crypto mining. With no need for ASIC hardware or massive energy overhead, it became an attractive option for early adopters looking to earn steady yields simply by locking up their tokens. But in 2025, the staking landscape has matured—and so have the […]

The Benefits and Risks of Staking for Institutional Crypto Investors

Institutional investors are increasingly looking at staking as an alternative investment strategy, drawn by the promise of consistent yields and deeper integration into blockchain ecosystems. However, staking is not a risk-free endeavor. For institutions managing large-scale digital asset operations, staking has emerged as a strategic alternative to traditional yield-generating instruments. Staking refers to the process […]